Computer depreciation rate

Office equipment computers laptop notebook gateway compaq dell pc computer drive cd rom desktop. The special depreciation allowance is 100 for qualified property acquired and placed in service after September 27 2017.

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

Not Book Value Scrap value Depreciation rate Where NBV is costs less accumulated depreciation.

. About Depreciation Rates in India. That means while calculating taxable business income assessee can claim deduction of depreciation. In fact for simplicity a depreciation period or rate might be determined for a complete group of assets eg.

How to Calculate Depreciation Using the Straight Line Method. Office Equipment - Computers Depreciation Rate. At the end of the 3 years the.

Mobileportable computers including laptop s tablets 2 years. If a company uses Written Down Value WDV method of depreciation it will need to calculate a new rate for depreciation to depreciate the asset over their remaining useful life. For example applications software such as.

Its refers to the decrease in the value of an asset over time. 170 rows Rate of depreciation shall be 40 if conditions of Rule 52 are satisfied. The formula to calculate depreciation through the double-declining method is.

Applicable from the Assessment year 2004-05. Alternatively you can depreciate the acquisition cost over a 5-year. Below we present the more common classes of depreciable properties and their rates.

Computers and computer equipment. 153 rows Computer-to-plate CtP platesetters including thermal and visible-light platesetters and. Diminishing Value Rate Prime Cost Rate Date of Application.

For tax purposes different types of office equipment and software depreciate at different rates hence the different CCA classes. You have purchased a computer for 1000 and estimate you will keep it for 3 years. Tangible Assets Intangible Assets Income Tax Rates.

Computers and computer equipment. Class 1 4 Class 3 5. Diminishing Value Rate Prime Cost Rate Date of Application.

Ltd- printers parties 60- cactus part rate imaging law peripherals pvt- of rate itat- 3159 2019 system vs- relied under cit abcaus ltd- at by vs- important enti. The rate of depreciation on computers and computer software is 40. Plant and machinery might be written off over say 10 years.

2500 per year Keywords. We also list most of the classes and rates at CCA classes.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

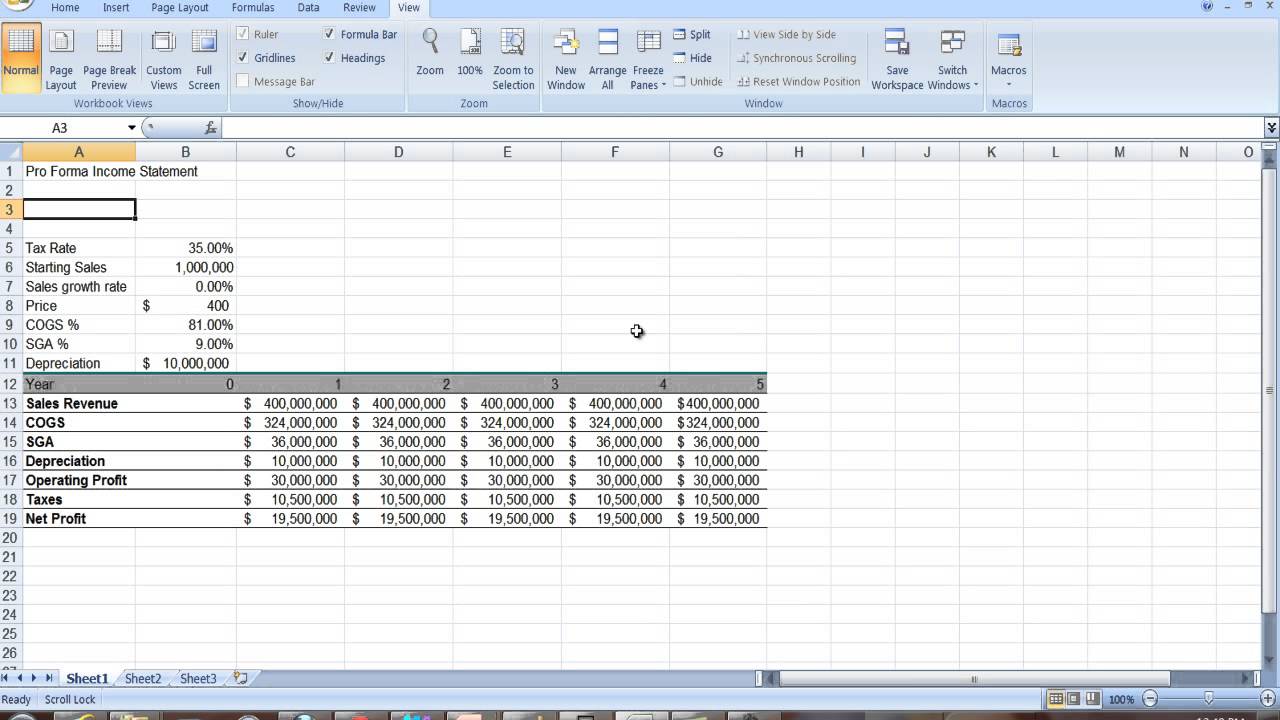

Depreciation In Excel

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

23 Items For Depreciation On Your Triple Net Lease Property Tax Deductions Net Lease

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Tax

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Basic Balance Sheet Balance Sheet Balance Sheet Template Money Basics

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

4 Tax Tips For Small Business Owners Tips Taxes Taxtime Income Tax Tips Tax Return Tips Small Business Tax Business Business Advice

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Employee Handbook

Youtube Income Statement Profit And Loss Statement Income

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Existential Comics On Twitter Productivity Computer Technology Business Process

Switches Routers Printer Server Etc Cannot Be Used Without Computer So They Form Part Of Peripherals Of The Computer A Router Switches Application Android

Callable Bonds Finance Investing Financial Strategies Accounting And Finance